Being an Trader, nevertheless, your options aren't restricted to stocks and bonds if you end up picking to self-direct your retirement accounts. That’s why an SDIRA can change your portfolio.

Making essentially the most of tax-advantaged accounts helps you to maintain additional of The cash that you choose to spend and receive. Depending on no matter whether you choose a standard self-directed IRA or simply a self-directed Roth IRA, you've the possible for tax-cost-free or tax-deferred growth, provided specific situations are fulfilled.

This involves knowledge IRS rules, running investments, and keeping away from prohibited transactions which could disqualify your IRA. A scarcity of information could lead to high-priced errors.

Choice of Investment Options: Ensure the supplier allows the categories of alternative investments you’re thinking about, for instance real estate property, precious metals, or non-public equity.

Entrust can assist you in getting alternative investments together with your retirement money, and administer the getting and promoting of assets that are generally unavailable via financial institutions and brokerage firms.

And because some SDIRAs like self-directed regular IRAs are subject to required minimal distributions (RMDs), you’ll must strategy in advance making sure that you have enough liquidity to meet The principles set by the IRS.

No, You can't spend money on your own small business that has a self-directed IRA. The IRS prohibits any transactions amongst your IRA and your personal business because you, as being the operator, are deemed a disqualified person.

Housing is among the most popular choices among SDIRA holders. That’s simply because you are able to spend money on any type of real-estate that has a self-directed IRA.

Have the freedom to invest in almost any type of asset that has a hazard profile that matches your investment technique; like assets that have the opportunity for the next fee of return.

Including money straight to your account. Take into account that contributions are matter to annual IRA contribution boundaries set via the IRS.

IRAs held at financial institutions and brokerage firms provide confined investment selections for their clientele mainly because they would not have the expertise or infrastructure to administer alternative home assets.

Imagine your Good friend might be commencing the subsequent Fb or Uber? With the SDIRA, you may spend money on causes that you believe in; and likely appreciate larger returns.

Increased investment solutions indicates you could diversify your portfolio beyond shares, bonds, and mutual resources and hedge your portfolio versus industry fluctuations and volatility.

Homework: It truly is referred to as "self-directed" for just a cause. Having an SDIRA, you happen to be completely responsible for comprehensively looking into and vetting investments.

An SDIRA custodian is different because they have the right staff, experience, and potential to keep up custody from the alternative investments. The first step in opening a self-directed IRA is to locate a service provider that is specialised in administering accounts for alternative investments.

Criminals often prey on SDIRA holders; encouraging them to open up accounts for the purpose of creating fraudulent investments. They frequently idiot traders by telling them that In case the investment is accepted by a self-directed IRA custodian, it should be legitimate, which isn’t correct. Again, You should definitely do extensive due diligence on all investments you end up picking.

Relocating resources from 1 sort of account to a different variety of account, including relocating money from a 401(k) to a traditional IRA.

Subsequently, they have an inclination not to Wealth preservation services market self-directed IRAs, which supply the flexibleness to invest Extra resources in a very broader choice of assets.

Better Costs: SDIRAs frequently feature bigger administrative expenses in comparison to other IRAs, as specified components of the administrative procedure can not be automatic.

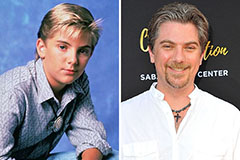

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Daniel Stern Then & Now!

Daniel Stern Then & Now! Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now!